Chapter 12 Accounting for Partnerships Test Bank

1464c1M as applicable or a national banks or savings associations purchase of acceptances created by other banks or savings associations that are eligible for rediscount under those sections. Free PDF of Commerce Class 11 12 textbook solutions can download here.

Mcq Questions Class 12 Accountancy Accounting For Partnership

Determination of taxable year and method of accounting changes.

. IB examinations test a students knowledge. Issue and allotment of equity shares private placement of shares Employee Stock Option Plan ESOP. This web-based vendor registration and purchasing system allows state agencies colleges universities and many local governments to use eVA to conduct all purchasing and sourcing activities for goods and services.

A Federal savings association that seeks to invest in a bank or savings association with a community development focus must comply with 16036 or any other applicable requirements. See Accounting Periods in chapter 2. Partnership deed is a partnership agreement between the partners of the firm which outlines the terms and conditions of.

A short summary of this paper. A short summary of this paper. According to a 2006 article the first partnership was implemented in 1383 by Francesco di Marco Datini a merchant of Prato and FlorenceThe Covoni company 1336-40 and the Del Buono-Bencivenni company 1336-40 have also been referred to as.

You must include it in your gross income for 2021. FINANCIAL ACCOUNTING STUDY TEXT CPA SECTION 1. A Except as specified in paragraph b the commissioner of health shall contract with the commissioner of human services to conduct background studies of.

A national bank that seeks to invest in a bank or savings association with a community development focus must comply with applicable requirements of 12 CFR part 24. These features of partnerships are documented in a document which is known as partnership deed. FYLSX or baby bar is a one-day test given remotely in June and October.

Whats New for 2021. What is a Partnership Deed. 1 individuals providing services that have direct contact as defined under section 245C02 subdivision 11 with patients and residents in hospitals boarding care homes.

CHAPTER EIGHT - SENTENCING OF ORGANIZATIONS Introductory Commentary The guidelines and policy statements in this chapter apply when the convicted defendant is an organization. Tax rates for individuals estates and trusts for taxable years after 1994. They were already in use in medieval times in Europe and in the Middle East.

Study with Quizlet and memorize flashcards containing terms like inDinero the company profiled in the opening feature for Chapter 10 is described by its cofounders as the fastest way for small businesses to manage their finances Which of the following is not true about inDineros founding story. Exemption under section 12-702 not applicable to trusts or estates. B the sample size for any given procedure must remain constant from audit to audit.

The auditor decides which items in the population to test before determining the sample size. 7 Full PDFs related to this paper. Cash-method accounting is an impermissible method for partnerships and Subchapter S- electing corporations.

Course Summary Accounting 101. There is much more emphasis on practical knowledge and how their studies can be applied. Financial Accounting has been evaluated and recommended for 3 semester hours and may be.

Organizations can act only through agents and under federal criminal law generally are vicariously liable for offenses committed by their agents. Partnerships have a long history. Trust funds received or held by trustees unless otherwise provided in the instrument creating the trust and funds received or held by guardians or conservators 1 may be invested in such real estate mortgages as the savings banks in this state may be authorized by law to.

EVA - Virginias eProcurement Portal - eVA is Virginias online electronic procurement system. The following are some of the tax changes for 2021. Full PDF Package Download Full PDF Package.

Specific questions regarding changes in accounting methods can be referred to the Methods of Accounting and Timing Practice Network. You do not withdraw it or enter it into your passbook until 2022. Accounting for share Capital Download DK Goel Solutions for Class 12 Accountancy Accounting for share Capital.

Nature and Types of share Capital. The provisions of this chapter shall be applicable with respect to any person trust. It takes seven days for ACH.

Start studying Chapter 9. Accounting for share capital. 372 and 373 or 12 USC.

You will need your Bank Routing Number and Bank Account Number. Full PDF Package Download Full PDF Package. Intermediate Accounting 16th Edition.

The next First-Year Law Students Exam is scheduled for October 25. Accounting fees C Cost of a greenhouse D Cost of uniforms for employees. Audit Evidence flashcards from Kia Rainey.

Assessing Control Risk And Reporting On Internal Controls Chapter 13. A For taxable years beginning after 1994 a tax is imposed on the South Carolina taxable income of individuals estates and trusts and any other entity except those taxed or exempted from taxation under Sections 12-6-530 through 12-6-550 computed at the following rates with the income. A In 2009 inDineors founders applied to TechStars which is a Boulder CO-based.

3 Full PDFs related to this paper. Returns for partnerships S corporations and pass-through entities. A national banks or savings associations acceptance of drafts eligible for rediscount under 12 USC.

D There is no accounting method that is. At the same time individual. Using the steps outlined in this chapter the Service examiner can evaluate the adequacy and accuracy of a cost segregation study and determine the proper classification and cost of property.

DK Goel Accountancy Class 12 Solutions Part A Volume 2. Learn vocabulary terms and more with flashcards games and other study tools. Interest is credited to your bank account in December 2021.

College Accounting Chapters 1 13

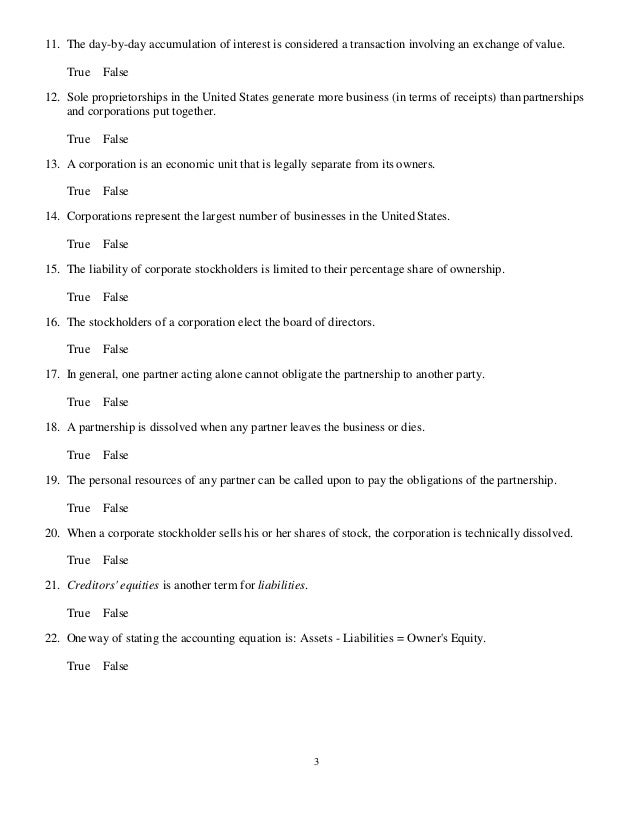

Test Bank For Principles Of Accounting 12th Edition By Needles

Test Bank For Macroeconomics 6th Edition By Williamson Ibsn 9780134472119 By Grucm Issuu

Ch 02 Solution Accounting Principles 12th Edition Accounting Principles 12th Edition Weygandt Studocu

0 Response to "Chapter 12 Accounting for Partnerships Test Bank"

Post a Comment